TLDR: China is a high-reward market for foreign businesses that treat setup, finance, and compliance as part of execution, not paperwork. The winners get the structure and operating basics right early so sales

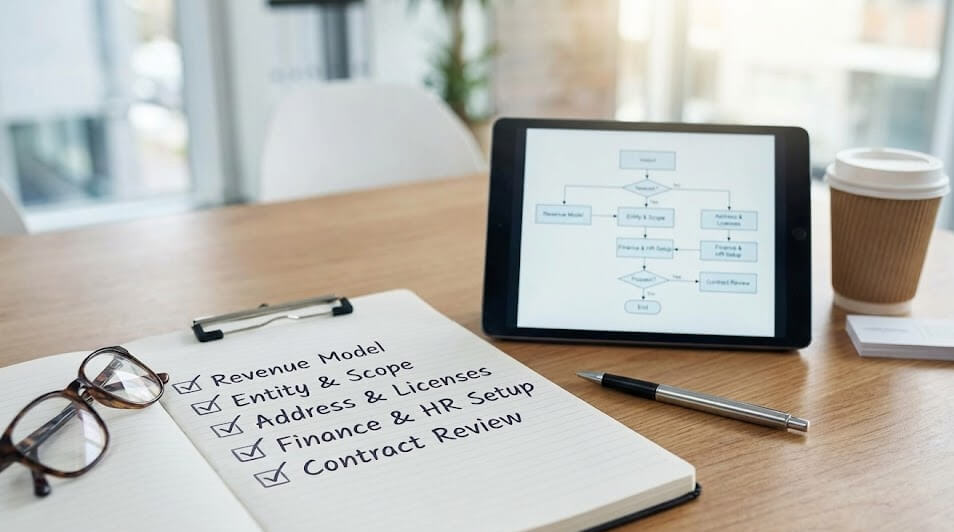

Key takeaways:

China can be one of the fastest places in the world to scale, but progress can slow quickly if the setup is not aligned to how you plan to operate. If you treat it like a standard market entry, you may run into avoidable delays, compliance friction, and missed opportunities.

China tends to favour companies that plan carefully and execute on the details. The rules are knowable, but they are layered, localised, and enforced through processes that do not always feel intuitive to first-time entrants.

A China strategy is more than a plan on paper. It is a chain of decisions that shapes your tax exposure, hiring ability, invoicing, banking, and how easily you can repatriate profits. If you get the early decisions right, your day-to-day operations become boring in the best way.

Before you file anything, decide how you will actually make money in China. Are you selling cross-border, operating locally, manufacturing, hiring staff, or partnering with a local operator to reach customers faster.

Your entry model determines what you need from your legal setup and what you must prove to regulators and banks. A mismatch here is one of the most common reasons timelines slip early.

Some businesses start with cross-border sales and use China to support partners, marketing, and customer success. Others enter with local operations because they need a China-based entity to hire, sign contracts, and invoice properly.

A third path is partnership-first where speed matters, and you use a local partner while building your own capability in parallel. This can work well, but it needs tight controls so you do not lose leverage over pricing, data, or customer relationships.

In practice, foreign investors usually consider a Wholly Foreign-Owned Enterprise (WFOE), a Joint Venture (JV), or a Representative Office (RO). The right choice depends on control, licensing needs, risk tolerance, and how much you must localise operations.

A WFOE often appeals because it offers more operational control, while a JV can make sense when market access or licensing depends on a local party. A Representative Office is more limited and is typically used for liaison work rather than revenue-generating operations.

A WFOE is usually the “build it properly” option when you need to trade, hire, and scale with fewer dependency risks. If you want to avoid the usual formation traps, this guide is worth saving: Common mistakes foreign investors make when forming a WFOE and how Tannet Group helps you avoid them.

A JV can be a shortcut to local capabilities, but it also creates governance complexity and requires clear agreements from day one.

A Representative Office is not a lightweight company, it is a restricted structure with specific allowed activities. If you need to issue local invoices and collect revenue, an RO is often the wrong tool.

Many industries require permits, registrations, or approvals beyond basic incorporation. Even when your industry does not look “regulated,” you may still need steps tied to import export, data handling, hiring, or specific sales activities.

Foreign businesses often lose time because they assume a single registration completes everything. The reality is a sequence where each step unlocks the next, and skipping one creates a domino delay.

China’s tax landscape includes ongoing filings, reporting expectations, and practical systems that touch daily operations. You do not need to become a tax expert, but you do need to know what will affect pricing, invoicing, and cash flow.

For many businesses, VAT and the handling of official invoices can be central to being paid smoothly. If this is not addressed early, you may close deals and still face friction collecting revenue in the way customers expect.

If you want a grounded sense of what is actually available and what gets missed, this is a useful reference: Tax benefits in China that many foreign businesses miss early on. It helps you think about tax as part of the operating plan, not a year-end scramble.

In China, official invoices are a functional part of how many companies manage deductions and compliance, not just a receipt. That means your ability to issue the right invoices can influence whether customers will buy from you in the first place.

This is why finance setup is best handled early, rather than after sales start. If you prepare properly, your commercial team will not be fighting preventable admin battles.

Employment in China is governed by rules around contracts, working hours, termination, and social insurance contributions. If you reuse templates from other countries without adapting them, you can create legal exposure and costly disputes.

The smarter approach is to build a compliant HR process early, even if your first hires are few. Getting employment contracts and payroll right protects the business and makes scale less stressful.

Payroll is tied to filings, tax withholding, and mandatory contributions in many cases. When payroll is incorrect, the risk is not just employee dissatisfaction, it can also create compliance issues that slow growth.

If you are scaling, you want payroll to be predictable and auditable. A clean process also helps when you later need due diligence for investors or strategic partners.

China is full of strong partners and capable suppliers, but you must protect yourself through clear contracting and practical enforcement steps. The goal is clarity and reducing ambiguity so deals do not drift when pressure appears.

This includes paying attention to who signs, what entity is legally responsible, and how disputes are handled. Small details like the correct company chop and aligned counterpart information can matter more than people expect.

The most successful foreign operators treat China like a standalone business unit with global alignment, not a side project. They invest early in structure, finance, and local execution, then let the commercial team do its job without being blocked by admin.

They also plan for localisation in communication, payment terms, and customer expectations. When you respect local buying behaviour, you shorten sales cycles and reduce churn.

Timelines vary based on city, entity type, and what licensing is needed. What you can control is how complete your documents are and whether your structure matches your actual plan.

If you try to rush without a solid foundation, you often end up slower. If you build a clean foundation, the process tends to move with fewer resets.

The biggest mistake is treating setup as an admin task instead of a strategic decision. The next biggest mistake is building a structure that looks clever on paper but makes banking, invoicing, and compliance harder.

Another common failure is underestimating local variation. China is not one uniform operating environment, and what works in one city or industry can require adjustment in another.

Tannet Group supports foreign investors with China business setup and follow-up services that cover structure selection, compliance, and the practical workstreams that often slow founders down. Their China service scope includes support across common entity types like WFOEs, JVs, and Representative Offices, with assistance on registration, licensing, and ongoing operational requirements.

If you want a cleaner path from “we want to enter China” to “we are operating compliantly,” having a team that deals with these processes daily can reduce resets and wasted weeks. The value is not just filing forms, but aligning the structure, documentation, and compliance rhythm with how you actually plan to run the business.

If you are serious about entering China, treat the foundation as part of your competitive advantage. To talk through the right setup for your situation, book a call and get a quote.

A short consultation can help you avoid mismatched structures, preventable delays, and compliance blind spots that surface only after money is already on the line. If you want to move faster with fewer surprises, this is the simplest next step.